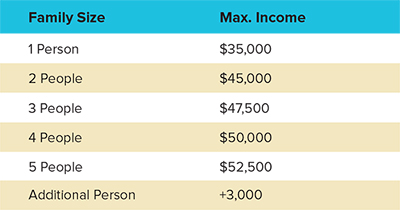

Filing your taxes every year is important to ensure you are receiving all the government benefits and subsidies you are eligible for. Even if you are not employed or do not have income, you still need to file your taxes.

Our service is free and confidential.

What is the process?

- Gather all your documents listed in the “what you need to bring” section below.

- Staff will assist you to fill out the required forms and check your documentation.

- All your paperwork will be put into an envelope for volunteers to use to complete your tax return throughout the week.

- Returns will be available for pick up 48 hours after you attend the clinic during mail hours, Monday to Friday 10 am to 4 pm.

What you need to bring:

- Government ID

- SIN

- Bank account number for direct deposit

Tax Slips:

- T4, T4E, T5, T5007

- T4A, T4A(P), T4A(OAS); Pension

- T2202A; Tuition

Receipts For:

- Charitable donations

- Medical/dental

- Child Care

- RRSP Contributions

- Last Year’s Notice of Assessment

If you are missing any of these items, you can call CRA at 1-800-959-8281. We can still prepare your taxes if you do not have the above information.

Just attend the Drop-Off Clinic for assistance at the Africa Centre.

We do not prepare:

- Self-employed income tax

- Rental income

- Farming & fishing income

- Bankruptcies

- Deceased persons

- Interest exceeding $1000

- Other tax returns that require a professional accountant

Who will be filing my taxes?

LCCMedia Foundation staff and volunteers

What If I Need Some Help While Doing My Taxes?

Contact: LCCMedia Foundation Low-Income Free Tax Clinic

Call: 780-860-3229

Email: taxes@lccmediafoundation.ca